MileIQ: Mileage Tracker & Log

توضیحات فارسی

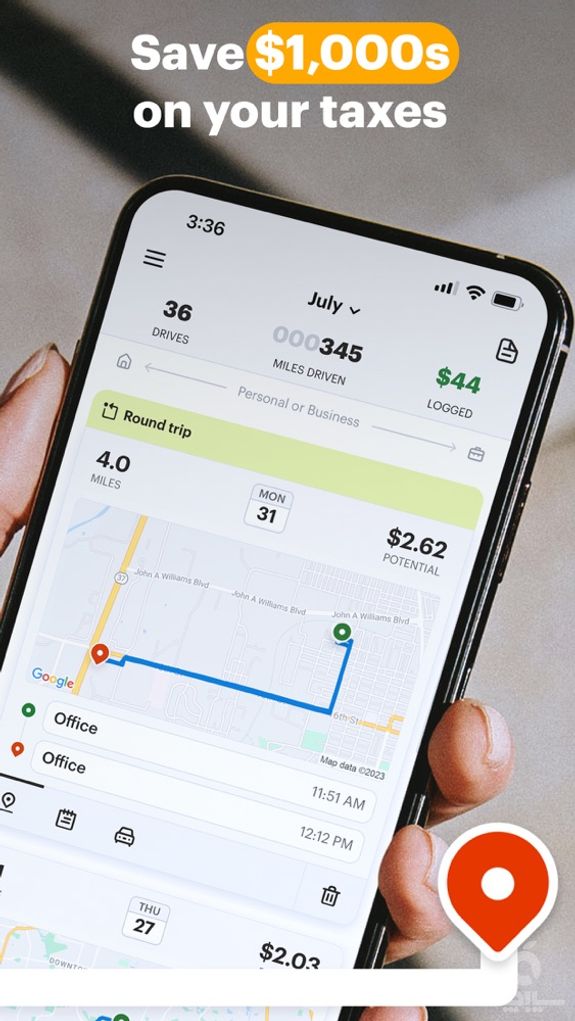

MileIQ automatically tracks and records your mileage in the background as you drive your car for business. MileIQ users save an average of $7,124 per year.

Tracking your miles for tax deduction purposes? MileIQ is the easiest most accurate way to create logs that follow IRS mileage standards.

Easy to Use. Loaded with Features. Two of the biggest mistakes manual paper log keepers make is not maintaining a contemporaneous mileage log and mixing their business miles with personal miles. Inaccurate record keeping can result in rejected mileage deduction claims and IRS penalties.

Automatic Mileage Detection MileIQ creates an accurate, contemporaneous record of the miles you drive for work. Automatic drive detection means no stopping and starting the app. No need for manual paper logs.

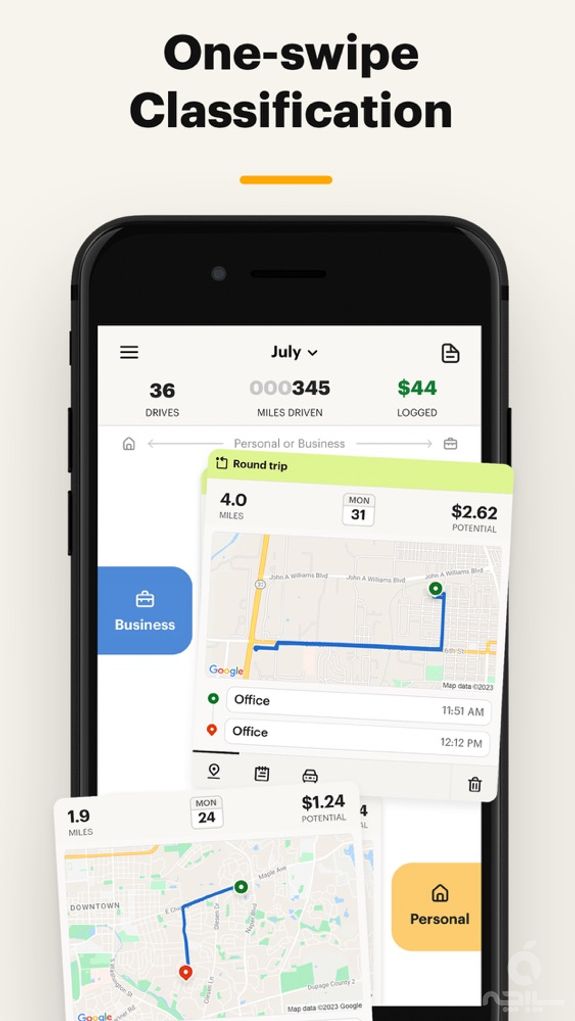

Accurate Mileage Tracking Features like Name Your Location and One Swipe Classification give your tax-deductible mileage records the accurate details they need to pass IRS scrutiny.

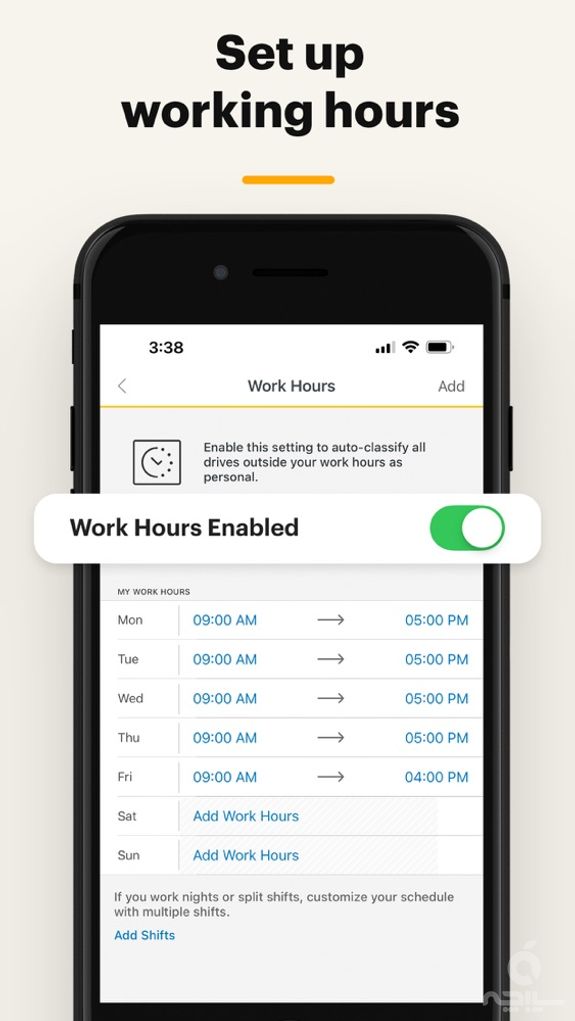

A Custom Fit No matter whether you're tracking miles for reimbursements or tax deductions, MileIQ gives you the tools and flexibility to create mileage record details that reflect the miles you drive.

• Personalize each drive with vehicle names, job numbers or any designation that fits your business • Use bulk editing to give groups of drives a single purpose • Use Frequent Drives to auto-classify the drives you make most often • Add drives, delete drives, duplicate drives, and more

Making Your Business Mileage Count The 2019 standard IRS mileage rate of 58 cents per mile driven for business, 14 cents for charity and 20 cents for medical mileage.

MileIQ calculates your largest mileage tax deduction. For example, let’s say you drive 1,000 or 10,000 miles for business using the standard mileage rate of 58 cents you’d be entitled to a mileage deduction of $580 or $5,800.

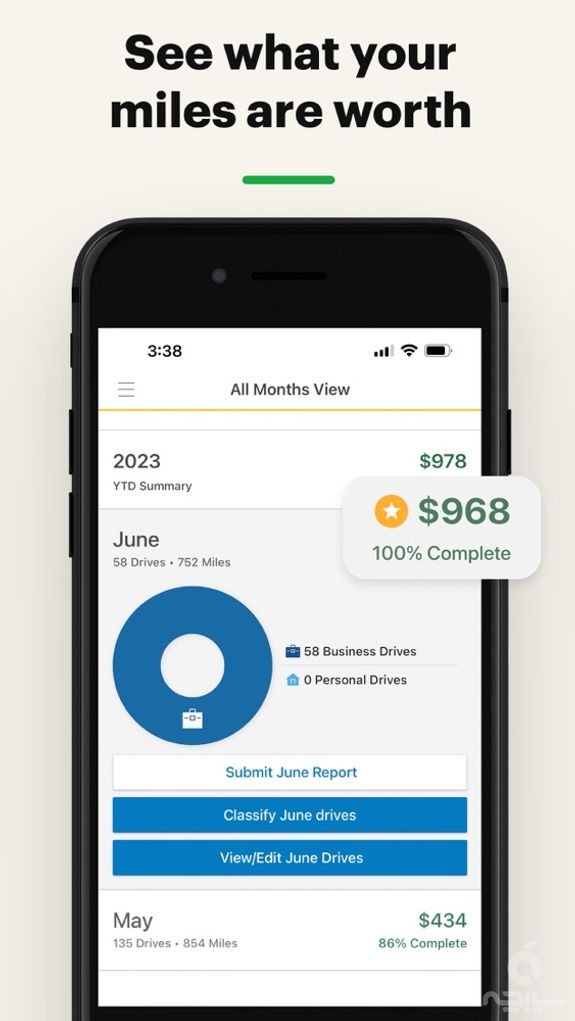

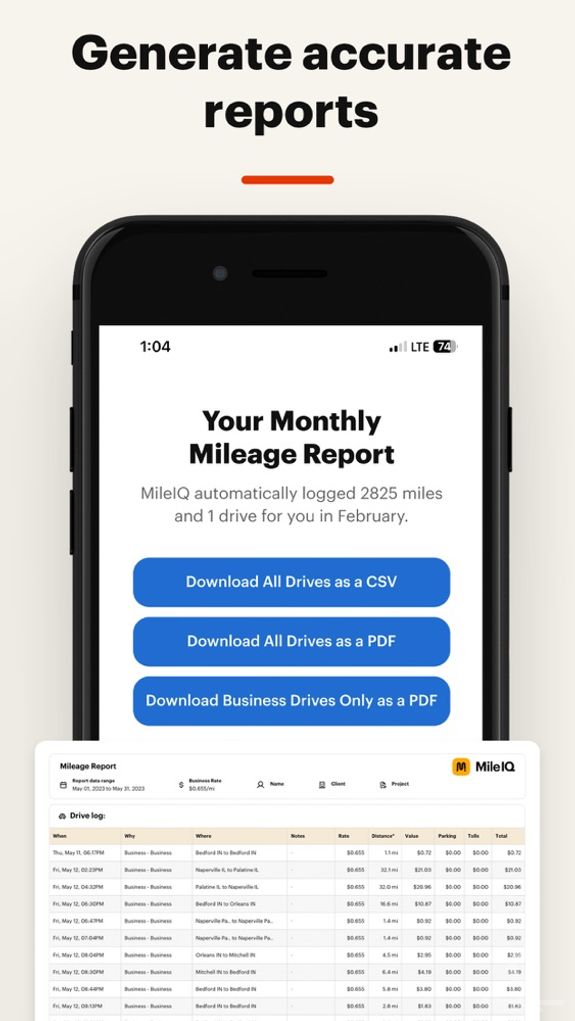

Detailed Records of Every Drive A mileage log is only as good as the reports it generates. Stored securely in the cloud, MileIQ sends weekly mileage reports directly to your inbox. Need more specificity, use the web dashboard to generate custom reports.

• $5.2 billion in mileage deductions and reimbursements

• 40.8 billion miles logged with MileIQ

• 338 million hours saved from manual logging

Join Millions of Drivers Who’ve Saved Billions of Dollars using MileIQ

Try MileIQ for free. Your first 40 drives are free every month.

For a complete record of all your drives upgrade to MileIQ Unlimited for only $5.99/month recurring or $59.99/year recurring.

Mileage Logging that Works

• Easy. Simple to install and use • Automatic. No stopping and starting the app • Organized. Classify your drives with a swipe • Accurate. Mileage logs that meet IRS mileage deduction standards

Battery Consumption

MileIQ consumes almost no power when stationary (as it quickly goes to "sleep"), and it will only minimally increase battery consumption when in transit. To achieve this minimal battery usage, MileIQ uses smartly constructed formulas to detect drives rather than only using GPS (which requires more power) for location data.

Learn more

• Help Center: https://support.mileiq.com • Website: http://www.mileiq.com • Blog: http://www.mileiq.com/blog • Twitter: twitter.com/mileiq • Facebook: www.facebook.com/mileiq • LinkedIn: www.linkedin.com/company/mileiq • Terms of Service: https://www.mileiq.com/terms • Privacy Policy: https://www.mileiq.com/privacy

Subscription Details

• Payment will be charged to your iTunes account at confirmation of purchase

• Subscription automatically renews unless the auto-renew is turned off at least 24-hours before the end of the current period

• Your account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user's account settings after purchase

توضیحات انگلیسی

Do you drive a personal car for work or need to track the miles you drive? MileIQ automatically tracks your drives and has logged more than 80B+ miles - that’s more than $10B reimbursed from the #1 trusted mileage tracking app.

Features At-a-Glance:

- Generate a mileage report for the IRS, your accountant, or for work.

- Record your drives automatically - no more starting and stopping!

- Classify your drives with a swipe! Right for business and left for personal drives.

- Smart drive detection groups round-trip drives and auto-classifies frequent trips.

Track Business Miles & Drives: MileIQ automatically tracks your drives in the background. MileIQ means you won’t have to manually log your miles or even manually start and stop recording. MileIQ creates a compliant mileage log for you.

Replace Your Paper Mileage Log: Say goodbye to the messy paperwork! The MileIQ business mileage tracker frees you from the pain of manually tracking your miles for taxes or reimbursement. MileIQ is a mileage tracking app that will automatically log and track miles, and calculate the value of your drives for taxes or reimbursements.

Prepare for Taxes: Our mileage tracker helps you easily organize your drives for your business expenses and tax refunds. MileIQ sorts your drives, keeping business miles separate from personal ones, which makes it simple to have a mileage log that will be accepted by the IRS or your business.

Track miles and quickly get the reports you need to maximize your tax deductions and reimbursements without the administrative struggles. MileIQ is trusted by millions of users for billions of drives!

Start Driving Now: Track your drives and log miles from your drives easily and accurately with MileIQ. Test it out for free and download your IRS friendly mileage log as a premium member.

Learn More: Privacy Policy: https://mileiq.com/privacy Terms of Service: https://mileiq.com/terms

| جزیيات بیشتر | Microsoft Corporation |

|---|---|

| تعداد دانلود | ۰ |

| حجم فایل | ۱۳۸.۸۵ MB |

| نسخه | ۲.۵.۰ |

| کمترین نسخه iOS | IOS 14.0 |

| رده سنی | 4+ |

| قیمت نهایی | رایگان |

نظرات

نظری ثبت نشده